Finance

Investing Psychology: The Real Reason You Keep Losing Money and How to Fix It

If you keep losing money in the stock market, it’s probably not just bad luck or poor timing—it’s often your own mind playing tricks on you. Many investors don’t realize the biggest obstacle to growing their wealth isn’t the market itself, but the subtle biases and emotions that influence every decision. In this article, you’ll learn how classic investing psychology traps cause people to lose money, how to spot these traps in your own thinking, and what you can do to protect your investments from your own worst instincts.

Why Your Brain Makes Investing So Hard

Money decisions are rarely just about numbers. Even the smartest, most rational people fall into mental traps when investing. The truth is, our brains are wired to make quick, emotional decisions—great for survival, but not for stock picking. Fear, greed, the desire to fit in, and a love for “sure things” can all cloud your judgment. That’s why so many people panic sell when prices drop or follow the crowd into bad investments at market peaks.

A 2022 study by Dalbar found that the average investor underperforms the S&P 500 by about 4 percent per year, mostly due to emotional buying and selling. That gap adds up to thousands, even millions, in lost returns over a lifetime.

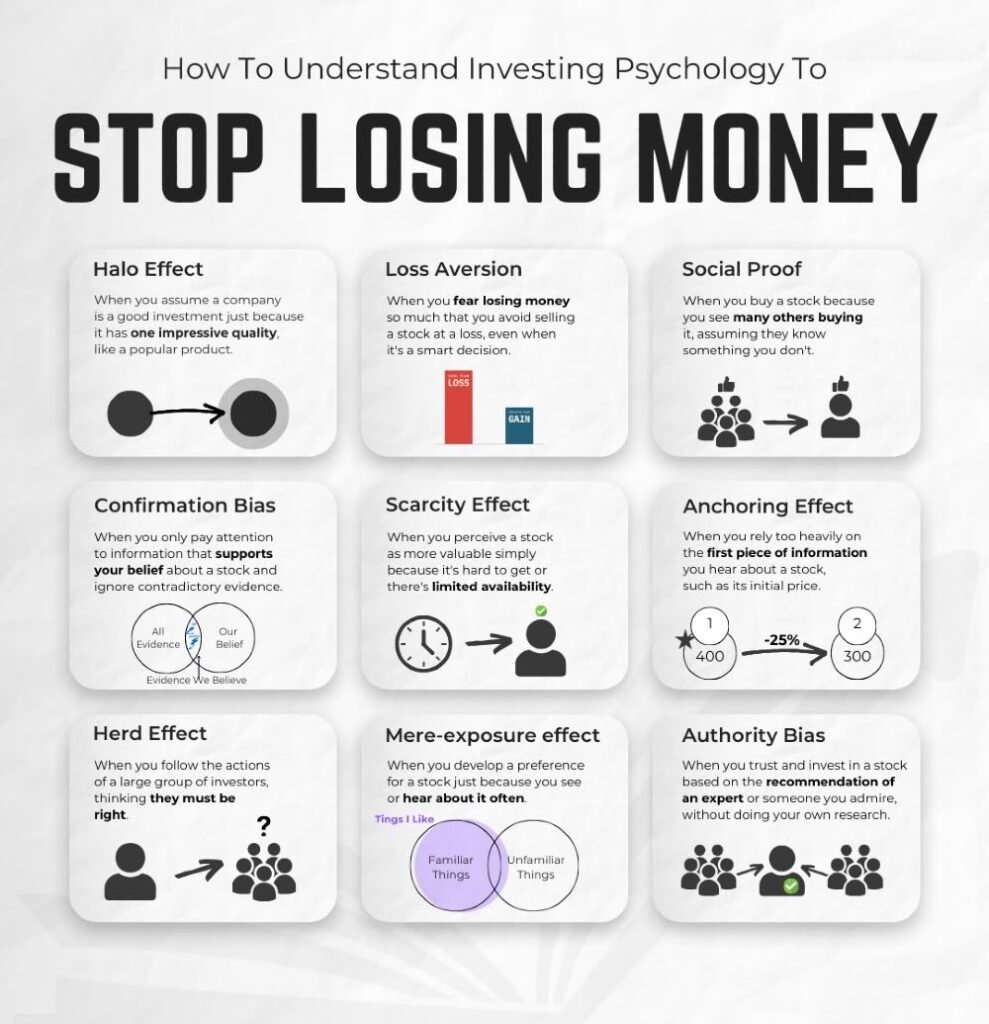

The Most Common Investing Biases That Make You Lose Money

Let’s break down the top psychological traps that cause investors to shoot themselves in the foot—often without even realizing it.

Loss Aversion: Why Selling at a Loss Feels Impossible

Nobody likes losing money, but research shows that people feel the pain of losses twice as much as they enjoy gains. This is called loss aversion, and it leads investors to hold onto losing stocks much longer than they should, hoping they’ll bounce back. Even when selling would be the smartest move, the fear of “locking in” a loss keeps people stuck.

A classic example is the investor who refuses to sell a stock that’s down 30 percent, waiting for it to get “back to even,” even if better opportunities are available elsewhere.

Table: How Loss Aversion Impacts Investing Decisions

| Scenario | Rational Action | Typical Emotional Response |

|---|---|---|

| Stock drops 20% | Sell if better options exist | Hold, hoping for rebound |

| Stock rises 20% | Reassess, consider taking profit | Hold, fearing missing out |

| Portfolio drops in a crash | Rebalance or buy more if possible | Panic sell or freeze |

The Herd Effect: Following the Crowd Usually Ends Badly

Humans are social creatures, and that doesn’t stop at investing. When everyone you know is jumping into a hot stock or asset, it’s tempting to join in. This is known as the herd effect. Unfortunately, by the time most people hear about a “can’t miss” opportunity, it’s already too late.

The dot-com bubble and the crypto booms are powerful reminders of what happens when everyone piles into the same trade. History shows that following the crowd is a recipe for buying high and selling low.

Confirmation Bias: Seeing Only What You Want to See

Confirmation bias is the tendency to seek out information that supports your existing beliefs and ignore anything that doesn’t. For investors, this means clinging to positive news about a stock you own while ignoring warning signs. Social media and investment forums can make this worse, creating echo chambers where everyone agrees and no one questions the risks.

This bias can lead people to double down on bad investments and miss important red flags that could save them from bigger losses.

Anchoring Effect: Getting Stuck on Irrelevant Numbers

Anchoring happens when you fixate on the first number you see—like the price you paid for a stock—and use it as a reference point for every decision. If you bought a share at $100, you might refuse to sell at $90, even if all signs point to further declines, just because you’re anchored to your original price.

In reality, the only thing that matters is where the stock is headed, not where it’s been. Anchoring makes it hard to cut losses or take profits when the facts change.

Authority Bias and Social Proof: Trusting the Wrong People

We all want to believe that someone else has the answers. Authority bias is when you put too much trust in “experts” or celebrity investors, while social proof describes the urge to follow what “everyone else” seems to be doing. Both can lead you into risky trades without doing your own homework.

A survey by FINRA found that 70 percent of new investors in 2021 made decisions based on social media recommendations, with many suffering losses after following unreliable advice.

How to Spot These Traps Before They Cost You

The first step to avoiding these common pitfalls is simply learning to recognize them in your own thinking. Self-awareness is your best defense. Here’s what you can do:

- Pause before making any big investing decision, especially if you’re feeling strong emotions.

- Ask yourself, “Am I doing this because of fear, greed, or because everyone else is?”

- Regularly review your portfolio with a critical eye, not just looking for confirmation of what you already believe.

Table: Symptoms of Investing Biases

| Bias Type | Typical Thoughts or Behaviors |

|---|---|

| Loss Aversion | “I can’t sell now—I’d be admitting I was wrong.” |

| Herd Effect | “Everyone’s buying this, I should too.” |

| Confirmation Bias | “I’ll only read positive news about my investments.” |

| Anchoring | “I’ll wait until it gets back to what I paid.” |

| Authority Bias | “This guru said buy, so it must be right.” |

Practical Strategies to Outsmart Your Own Psychology

It’s one thing to know about investing psychology, but actually changing your behavior is another challenge. Here are some practical tips to help you avoid costly mistakes:

- Set clear rules for buying and selling before you invest. Stick to them, even when emotions run high.

- Use automatic investing plans to keep your emotions out of the process.

- Keep a written investment journal to track your decisions and the reasons behind them. This helps you spot patterns and stay honest with yourself.

- Diversify your portfolio to reduce the impact of any single bad decision.

- Talk through big decisions with a trusted friend or advisor who can offer an outside perspective.

- Limit how often you check your portfolio to avoid making knee-jerk reactions to short-term moves.

Real-World Example: The Danger of the Halo Effect

Imagine you hear about a company that’s launching a popular new product—everyone is talking about it and the media is glowing. You assume the company is a great investment just because of this one impressive quality. This is the halo effect in action.

In 2017, many investors rushed to buy shares of companies announcing a move into artificial intelligence or blockchain, even if these moves had little impact on their actual business. Most of these stocks fell back to earth once the hype faded, leaving latecomers with big losses.

Why Understanding Investing Psychology Matters More Than You Think

Ignoring your own psychology can quietly drain your wealth year after year. According to a Vanguard study, investors who stick to a disciplined plan outperform those who try to time the market by an average of 1.5 percent annually. Over decades, that difference can add up to hundreds of thousands of dollars.

Learning to manage your emotions and biases isn’t just about avoiding mistakes. It can also help you spot opportunities others are missing and stay calm when everyone else is panicking.

Frequently Asked Questions

How do I know if I’m making decisions based on emotion?

If you find yourself acting quickly, feeling anxious, or unable to explain your choices logically, emotions are probably in the driver’s seat. Keeping a journal helps you spot this.

Can you completely avoid all investing biases?

No one is immune to biases, but being aware of them helps you catch yourself before making costly mistakes.

What should I do if I realize I’ve fallen into a bias trap?

Pause, review your original plan, and consider talking it over with someone you trust before acting further.

Is it ever okay to follow the crowd?

Sometimes crowds are right, but if you’re only following because of FOMO (fear of missing out), it’s a warning sign to step back and think things through.

How can I overcome loss aversion?

Set rules for when to sell, and remind yourself that losses are a normal part of investing. Focus on the long-term picture, not short-term pain.

Are professional investors affected by these biases too?

Absolutely. Even experienced pros fall into these traps, which is why many use strict rules and outside advisors to keep themselves honest.

Does diversification really help avoid bias?

Yes, spreading your investments helps limit the impact of any single mistake and keeps your emotions in check.

Conclusion

Understanding investing psychology is the secret weapon that can help you stop losing money and start making smarter decisions. If you found this helpful, please share it with friends or leave a comment below with your own experiences or questions. Let’s learn and grow together!

News11 months ago

News11 months agoTaiwanese Companies Targeted in Phishing Campaign Using Winos 4.0 Malware

News11 months ago

News11 months agoApple Shuts Down ADP for UK iCloud Users Amid Government Backdoor Demands

News10 months ago

News10 months agoJustin Baldoni Hits Back at Ryan Reynolds, Calling Him a “Co-Conspirator” in Blake Lively Legal Battle